Homeowners Insurance in and around Washington

A good neighbor helps you insure your home with State Farm.

Help cover your home

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

It's so good to be home, especially when your home is protected by State Farm. You never have to worry the accidental with this terrific insurance.

A good neighbor helps you insure your home with State Farm.

Help cover your home

Protect Your Home Sweet Home

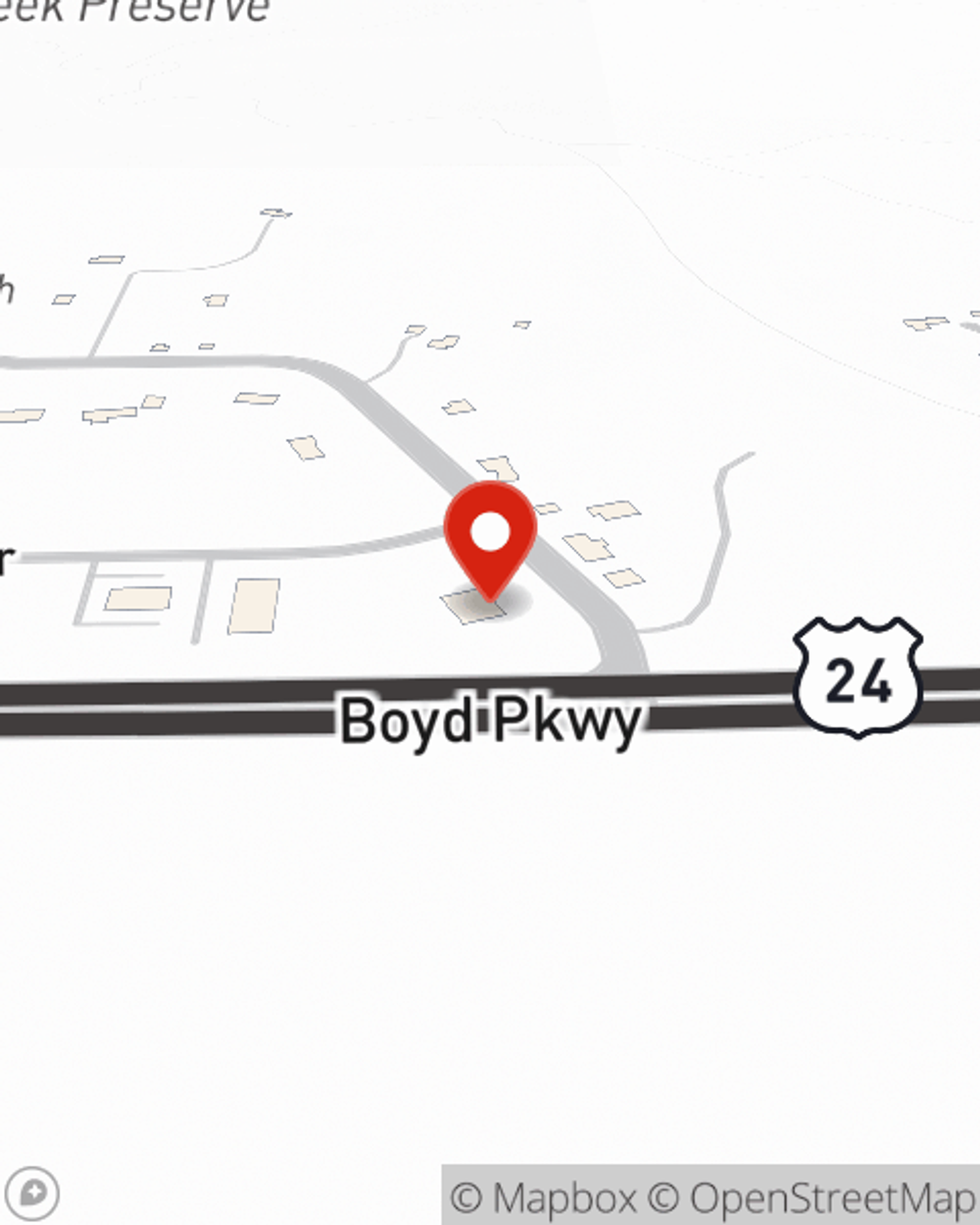

Great coverage like this is why Washington homeowners choose State Farm insurance. State Farm Agent Corey North can offer coverage options for the level of coverage you have in mind. If troubles like wind and hail damage, sewer backups or service line repair find you, Agent Corey North can be there to help you file your claim.

Call or email State Farm Agent Corey North today to explore how a State Farm policy can help protect your home here in Washington, IL.

Have More Questions About Homeowners Insurance?

Call Corey at (309) 694-6285 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

What to do after a hurricane

What to do after a hurricane

Helpful tips to prevent further water damage, safely begin cleaning up and finding a contractor to help repair damage to your property.

Corey North

State Farm® Insurance AgentSimple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

What to do after a hurricane

What to do after a hurricane

Helpful tips to prevent further water damage, safely begin cleaning up and finding a contractor to help repair damage to your property.